Standard Deduction Charitable Contributions 2022 . — for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. As a general rule, you can deduct donations totaling up to. — standard deduction amounts. — cash donations for 2022 and later are generally limited to 60% of the taxpayer’s adjusted gross income (agi). The 60% agi ceiling on charitable cash. starting with tax year 2022, your deduction for cash contributions is limited to 60% of your agi minus your deductions for all. publication 526 explains how to claim a deduction for charitable contributions. — in that case, you'd claim charitable donations on schedule a (form 1040). — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. In a normal tax year, the 60 percent donations cap would apply to most cash contributions, regardless.

from financialdesignstudio.com

— for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. The 60% agi ceiling on charitable cash. — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. In a normal tax year, the 60 percent donations cap would apply to most cash contributions, regardless. — standard deduction amounts. publication 526 explains how to claim a deduction for charitable contributions. starting with tax year 2022, your deduction for cash contributions is limited to 60% of your agi minus your deductions for all. — in that case, you'd claim charitable donations on schedule a (form 1040). As a general rule, you can deduct donations totaling up to. — cash donations for 2022 and later are generally limited to 60% of the taxpayer’s adjusted gross income (agi).

A 2020 Charitable Giving Strategy You Don't Want to Miss!

Standard Deduction Charitable Contributions 2022 — standard deduction amounts. publication 526 explains how to claim a deduction for charitable contributions. — in that case, you'd claim charitable donations on schedule a (form 1040). As a general rule, you can deduct donations totaling up to. The 60% agi ceiling on charitable cash. — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. starting with tax year 2022, your deduction for cash contributions is limited to 60% of your agi minus your deductions for all. In a normal tax year, the 60 percent donations cap would apply to most cash contributions, regardless. — for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. — cash donations for 2022 and later are generally limited to 60% of the taxpayer’s adjusted gross income (agi). — standard deduction amounts.

From www.taxdefensenetwork.com

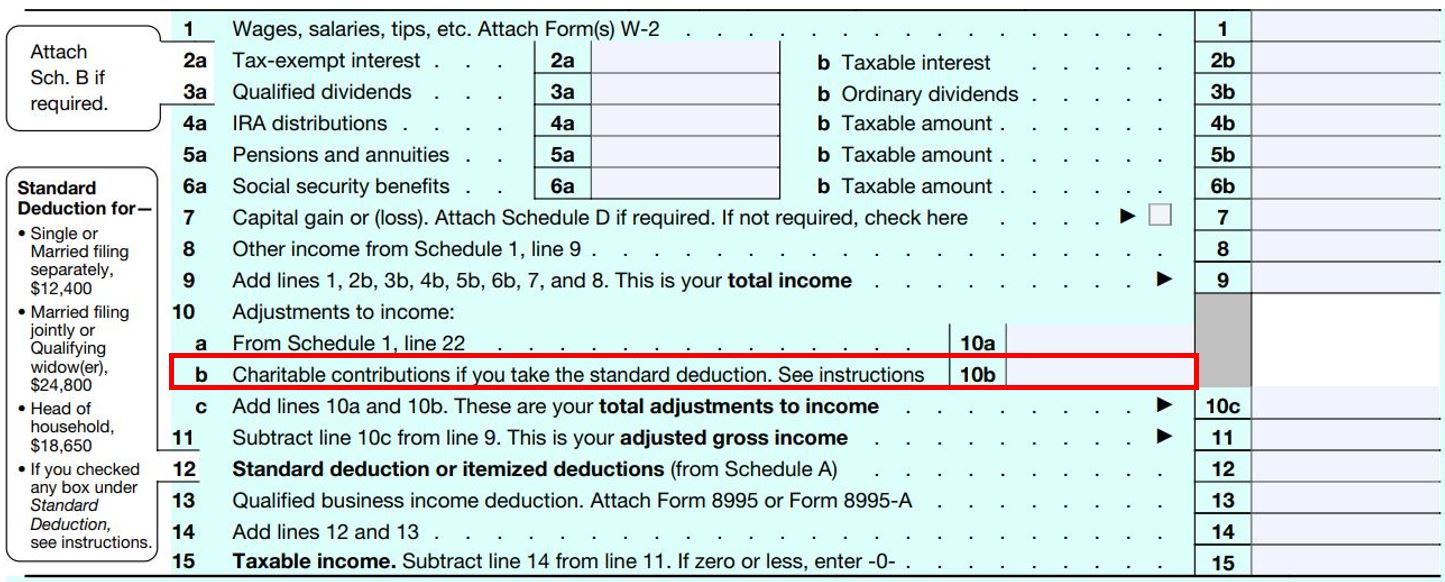

Should You Take The Standard Deduction on Your 2021/2022 Taxes? Standard Deduction Charitable Contributions 2022 In a normal tax year, the 60 percent donations cap would apply to most cash contributions, regardless. starting with tax year 2022, your deduction for cash contributions is limited to 60% of your agi minus your deductions for all. As a general rule, you can deduct donations totaling up to. — charitable contributions must be claimed as itemized. Standard Deduction Charitable Contributions 2022.

From taxfoundation.org

The Most Popular Itemized Deductions Tax Foundation Standard Deduction Charitable Contributions 2022 — standard deduction amounts. — in that case, you'd claim charitable donations on schedule a (form 1040). — cash donations for 2022 and later are generally limited to 60% of the taxpayer’s adjusted gross income (agi). publication 526 explains how to claim a deduction for charitable contributions. The 60% agi ceiling on charitable cash. starting. Standard Deduction Charitable Contributions 2022.

From www.pinterest.com

Donation Letter for Taxes Template in PDF & Word (Set of 10) Donation Standard Deduction Charitable Contributions 2022 — for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. starting with tax year 2022, your deduction for cash contributions is limited to 60% of your agi minus your deductions for all. In a normal tax year, the 60 percent donations cap would apply to most cash. Standard Deduction Charitable Contributions 2022.

From www.globalgiving.org

Everything You Need To Know About Your TaxDeductible Donation Learn Standard Deduction Charitable Contributions 2022 — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. The 60% agi ceiling on charitable cash. — for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. publication 526 explains how to claim a deduction for charitable contributions. As a. Standard Deduction Charitable Contributions 2022.

From www.dontmesswithtaxes.com

Make sure you claim your charitable tax deductions, on Form 1040 or Standard Deduction Charitable Contributions 2022 — standard deduction amounts. The 60% agi ceiling on charitable cash. In a normal tax year, the 60 percent donations cap would apply to most cash contributions, regardless. — for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. — in that case, you'd claim charitable donations. Standard Deduction Charitable Contributions 2022.

From old.sermitsiaq.ag

Charitable Contribution Receipt Template Standard Deduction Charitable Contributions 2022 — standard deduction amounts. publication 526 explains how to claim a deduction for charitable contributions. In a normal tax year, the 60 percent donations cap would apply to most cash contributions, regardless. As a general rule, you can deduct donations totaling up to. The 60% agi ceiling on charitable cash. starting with tax year 2022, your deduction. Standard Deduction Charitable Contributions 2022.

From cloblorelei.pages.dev

2025 Charity Deduction Milka Amabelle Standard Deduction Charitable Contributions 2022 — for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. publication 526 explains how to claim a deduction for charitable contributions. — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. starting with tax year 2022, your deduction for. Standard Deduction Charitable Contributions 2022.

From slideplayer.com

The key changes you need to know for the 2018 tax year ppt download Standard Deduction Charitable Contributions 2022 — in that case, you'd claim charitable donations on schedule a (form 1040). As a general rule, you can deduct donations totaling up to. starting with tax year 2022, your deduction for cash contributions is limited to 60% of your agi minus your deductions for all. — for giving money, goods, or property to certain types of. Standard Deduction Charitable Contributions 2022.

From wealthfit.com

How to Maximize Your Charity Tax Deductible Donation WealthFit Standard Deduction Charitable Contributions 2022 — cash donations for 2022 and later are generally limited to 60% of the taxpayer’s adjusted gross income (agi). starting with tax year 2022, your deduction for cash contributions is limited to 60% of your agi minus your deductions for all. — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040.. Standard Deduction Charitable Contributions 2022.

From dollarkeg.com

What's The Maximum Donation Deduction For Taxes Dollar Keg Standard Deduction Charitable Contributions 2022 publication 526 explains how to claim a deduction for charitable contributions. — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. — standard deduction amounts. starting with tax year 2022, your deduction for cash contributions is limited to 60% of your agi minus your deductions for all. As a general. Standard Deduction Charitable Contributions 2022.

From www.moneycrashers.com

Tax Deductions for Charitable Contributions & Donations Standard Deduction Charitable Contributions 2022 — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. — cash donations for 2022 and later are generally limited to 60% of the taxpayer’s adjusted gross income (agi). starting with tax year 2022, your deduction for cash contributions is limited to 60% of your agi minus your deductions for all.. Standard Deduction Charitable Contributions 2022.

From printablelibrarydon.z13.web.core.windows.net

Salvation Army Donation Form Pdf Standard Deduction Charitable Contributions 2022 In a normal tax year, the 60 percent donations cap would apply to most cash contributions, regardless. The 60% agi ceiling on charitable cash. — standard deduction amounts. — for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. starting with tax year 2022, your deduction for. Standard Deduction Charitable Contributions 2022.

From yokoymireielle.pages.dev

2024 Standard Deduct … Heidi Kristel Standard Deduction Charitable Contributions 2022 In a normal tax year, the 60 percent donations cap would apply to most cash contributions, regardless. — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. publication 526 explains how to claim a deduction for charitable contributions. The 60% agi ceiling on charitable cash. — standard deduction amounts. —. Standard Deduction Charitable Contributions 2022.

From lessondbgerste.z13.web.core.windows.net

Standard Deduction Worksheets For Dependents Standard Deduction Charitable Contributions 2022 As a general rule, you can deduct donations totaling up to. — standard deduction amounts. — for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. — cash donations for 2022 and later are generally limited to 60% of the taxpayer’s adjusted gross income (agi). —. Standard Deduction Charitable Contributions 2022.

From www.chegg.com

Problem 529 Contributions (LO 5.9) Jerry made the Standard Deduction Charitable Contributions 2022 starting with tax year 2022, your deduction for cash contributions is limited to 60% of your agi minus your deductions for all. — cash donations for 2022 and later are generally limited to 60% of the taxpayer’s adjusted gross income (agi). publication 526 explains how to claim a deduction for charitable contributions. — standard deduction amounts.. Standard Deduction Charitable Contributions 2022.

From mayebanaliese.pages.dev

2024 Taxes Charitable Deduction Olive Ashleigh Standard Deduction Charitable Contributions 2022 — standard deduction amounts. publication 526 explains how to claim a deduction for charitable contributions. — in that case, you'd claim charitable donations on schedule a (form 1040). — cash donations for 2022 and later are generally limited to 60% of the taxpayer’s adjusted gross income (agi). In a normal tax year, the 60 percent donations. Standard Deduction Charitable Contributions 2022.

From www.entrepreneur.com

4 Ways Charitable Giving Can Help Reduce Your 2020 Taxes Standard Deduction Charitable Contributions 2022 — for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. The 60% agi ceiling on charitable cash. publication 526 explains how to claim a deduction for charitable contributions. — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. —. Standard Deduction Charitable Contributions 2022.

From growthmastery.net

Charitable Contributions and How to Handle the Tax Deductions Standard Deduction Charitable Contributions 2022 The 60% agi ceiling on charitable cash. publication 526 explains how to claim a deduction for charitable contributions. — charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. — in that case, you'd claim charitable donations on schedule a (form 1040). As a general rule, you can deduct donations totaling up. Standard Deduction Charitable Contributions 2022.